The overall market ended the week to the upside which I was not expecting today to go, but I did not take any major bets on the downside, which makes it all kind of a shrug. Last night we got earnings and outlook from both Apple which has a fair bit of tariff risk associated with it, and Amazon which has tremendous associated tariff risk.

Somehow neither of these earnings reports didn't do too much to dampen the mood today. The decent April jobs report probably had something to do with optimism..

Then I heard an analyst on Bloomberg refer to institutions sitting on the side line and today's rally largely being retail investors which got me curious. One potential indicator for low institutional purchasing or an otherwise lacklustre day can be trading volume for SPY and QQQ, the latter featured below, we see a noticeable drop in volume for today's trading session:

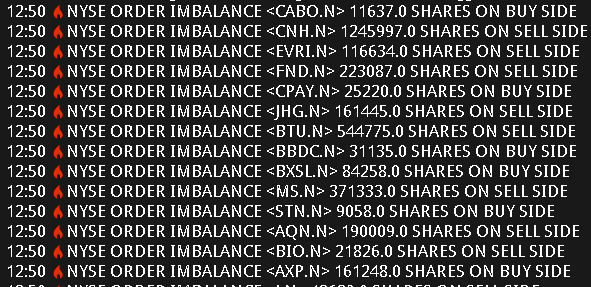

The retail rally theory does seem to hold water, though I did spot a big institutional play causing a trade imbalance towards the end of the session. That will typically drive prices up temporarily, but I was too distracted to execute any puts this late in the session:

These order imbalances typically drive up an entire sector temporarily, as you can see with semiconductors in the charts below:

Heading into next week's earnings, I remain fairly skeptical for the outlook on some of my holds:

- AMD

- Datadog (DDOG)

- Shopify (SHOP)

For AMD I have open put options which I am hoping go into the money after earnings. While I remain optimistic long-term for AMD, I don't expect strong performance until later in 2025 or even 2026 to be honest. The cutting back of data center contracts by major cloud providers that has happened thus far in 2025 also has me expecting an earnings miss and bad outlook. The miss on cloud earnings from Amazon (AMZN) I am expecting to adversely affect AMD as well.

My cynicism for SHOP and DDOG is manifested in covered calls. Their earnings are unpredictable enough to where I don't have a good hunch on how to leverage put options around their earnings.

Finishing another confusing week in this market is an accomplishment unto itself! I'm happy to close it out and see how the remainder of earnings go next week!

Log

- Not planning to do much trading today but was closely monitoring fluctuations for the day to close out some call options ahead of the close where necessary.

- Did not expect the rally over the past couple days with Datadog (DDOG) and ended up taking a small loss on some of those call options, but much better than having those options exercised!

- AMD was bouncing all over the place but fortunately my covered calls which were behind I was able to close without realizing losses but I didn't get as much upside as possible.

- Intentionally closed some covered calls before expiry because I was anticipating a rally into the close. With earnings next week for AMD, DDOG, and Shopify (SHOP) I wanted to make sure I sold covered calls to take advantage of the higher earnings week premiums.

Portfolio

Trades

- AMD 02MAY25 98 C

- AMD 02MAY25 100 C

- AMD 09MAY25 104 C

- AMD 09MAY25 110 C

- DDOG 02MAY25 102 C

- DDOG 02MAY25 104 C

- DDOG 02MAY25 105 C

- DDOG 09MAY25 117 C

- DDOG 09MAY25 120 C

- SHOP 02MAY25 100 C

- SHOP 09MAY25 109 C

- SHOP 09MAY25 114 C

- TSLA 09MAY25 290 P

Holding

Equities

- AMD

- DDOG

- IBKR

- SHOP